They may work in various markets, such as equities, options, or futures, and they use various trading strategies, such as swing trading, day trading, or value investing. Scalping entails the buying and selling of financial instruments such as stocks, futures, currencies, and commodities in quick succession, with the goal of producing small gains on the positions. The time frame that scalp traders hold positions ranges from seconds to minutes.

Consult an attorney or tax professional regarding your specific situation. Their colleagues, clients, bosses, and other stakeholders need to quickly and effectively understand what their trader is saying so that they can make informed decisions. Trading is an intense profession, and traders need to effectively manage their emotions in a highly stressful environment.

Collocations with trader

News or events can affect the price trends of the swing trader’s portfolio. Numerous traders also work for alternative investment managers, which are often responsible for a significant portion of market arbitrage trading, as well. Alternative managers can include hedge funds and private capital managers. These investment companies are actively trading a wide range of securities and financial instruments on a daily basis. Individual traders, also called retail traders, often buy and sell securities through a brokerage or other agent.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues.

Trader Operations: Institution vs. Own Account

Traders may work in the physical office or remotely, depending on the nature of the trading activity and the firm’s policies. Traders employ many strategies to produce and maintain profitability. Some of these strategies include scalping, day trading, swing trading, event trading, and position trading. It should be noted that no trading strategy is foolproof; there are advantages and disadvantages to any trading strategy. A bond trader is someone who specializes in trading fixed-income securities such as corporate bonds or Treasuries.

ASX Futures Bloom: A Comprehensive Guide to Understanding and … – NNN NEWS NIGERIA

ASX Futures Bloom: A Comprehensive Guide to Understanding and ….

Posted: Mon, 07 Aug 2023 22:47:39 GMT [source]

The risk in scalping lies in the quick generation of successive losses rather than gains. Swing trading involves profiting from short- to medium-term price movements in various financial instruments such as stocks, futures, currencies, or commodities. Unlike scalpers and day traders, swing traders hold their positions for longer time periods. This can be for several days, weeks, or even months and is dependent on the asset, the trend, and the other existing positions of the swing trader. The strategy of day trading involves taking positions in financial assets such as stocks, futures, currencies, and commodities within the same trading day. Day traders tend to hold an abundance of trades over minutes and hours, as they maneuver their transactions through changing market conditions.

Stock traders (or equity traders) are people who trade in equity securities. Their primary goal is to purchase and sell shares in different companies and try to profit off short-term gains from stock price fluctuations for themselves or for their clients. A stock trader is a person who attempts to profit from the purchase and sale of securities such as stock shares. Stock traders can be professionals trading on behalf of a financial company or individuals trading on behalf of themselves. Stock traders participate in the financial markets in various ways. Companies that hire traders generally offer employee training programs that focus on the business and the particular types of assets sold by the firm.

What is investing?

The equity market is also much more volatile than the debt securities market. Traders buy and sell more frequently, while investors typically buy and hold for the long term. New traders should look for a broker who can teach them the tools of the trade. Some offer educational articles, online tutorials and in-person seminars. Other features to consider with stock trading apps are the quality and availability of screening and stock analysis tools, on-the-go alerts, easy order entry and customer service. The IRS applies different rules and tax rates and requires the filing of different forms for different types of traders.

We believe everyone should be able to make financial decisions with confidence. Fundamental information, or fundamentals, refers to data that provide insights into the underlying intrinsic value of the financial asset, such as a stock, bond, future, currency, or commodity. Traders stock trader meaning play a critical role in providing liquidity to financial markets. Their activities are essential for the smooth functioning of financial markets and the allocation of capital to productive uses. Help support Wordnik (and make this page ad-free) by adopting the word stock trader.

Stock Trader Definition

Trading penny stocks is one market strategy that can be highly profitable for individuals. Traders can buy large quantities of penny stocks at low prices, generating significant market gains. Penny stocks usually trade on over-the-counter exchanges with transactions that can be easily facilitated through discount brokerage platforms.

- Contrarian traders identify overbought or oversold conditions in conjunction with trend reversals.

- Individuals can’t trade directly on a stock or commodity exchange on their own account, so using a discount broker is a cost-effective way to gain access to the markets.

- Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets or in some instances in equity crowdfunding platforms.

- For traders working on their own behalf, generating income will depend on implementing a successful trading strategy and effectively managing risk.

- Some of these strategies include scalping, day trading, swing trading, event trading, and position trading.

- They are usually issued with a fixed interest rate which is determined by the ability of the issuer to repay the debt.

While the pluses and minuses of compounding impact both investors and traders, trading may come with greater risks when it comes to compounding because of the shorter timeline to recoup losses. Investing for the long term gives your money the chance to recover and grow again following a downturn. Being a successful investor doesn’t require finding the next great breakout stock before everyone else.

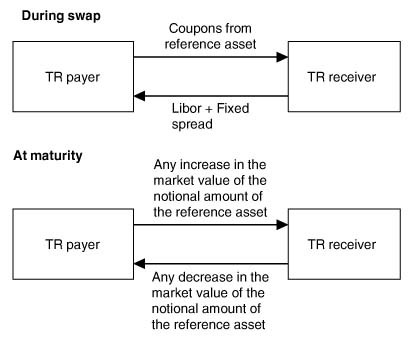

Interest rate risk

Swing traders, like many traders, use chart patterns and technical analysis to search for entry setups and exit points. Institutional stock traders may have their own capital portfolios for which to earn profits. These traders are typically known for their market intelligence and ability to profit from arbitrage opportunities.

The asset class is dependent on the traders’ preference, expertise, and the market in which they operate. Also, traders can choose to specialize in one asset class or more, depending on their goals and skills. This is essential to make informed decisions and be profitable in their activities.

The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

If a serious investor is unable to outperform the benchmark (something even pro investors struggle to do), then it makes sense to invest in a low-cost index mutual fund or ETF. That’s a basket of stocks whose returns closely align with one of the benchmark indexes. If that level of income seems attractive, there is good news about the employment outlook for the industry, as predictions call for a healthy availability of jobs over the coming years. The BLS estimates that employment for securities, commodities, and financial services sales agents will grow 10% from 2021 to 2031, exceeding the average for all occupations. While competition for these positions may be intense given the necessary skills involved, the BLS estimates that 46,600 job openings per year in this area over the decade. Discount brokerage firms charge significantly lower commissions per transaction but provide little or no financial advice.